Afan revealed this at the side line of the Validation of Community Participatory Assessment of Government Expenditure on Agriculture/Community Score Cards on Smallholder Women Farmers Access to Agricultural Insurance Services in Nigeria.

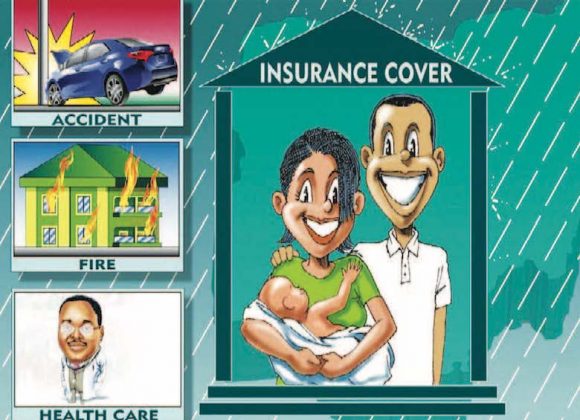

According to her, insurance is a major problem to small holder farmers as many women in the rural area do not have access to insurance covers that will indemnify their projects even those who have,