Australia has seen a surge of interest from key partners in Europe and Asia in its strategic critical minerals reserve following a landmark agreement with the United States last month, Trade Minister Don Farrell said on Wednesday.

The growing attention comes as Canberra positions itself as a dependable supplier of rare earths, lithium, and other minerals that have become essential to sectors ranging from defence manufacturing to advanced technology. Australia’s push also follows Beijing’s recent export restrictions on some rare earths, raising concerns among Western governments about secure access to supply.

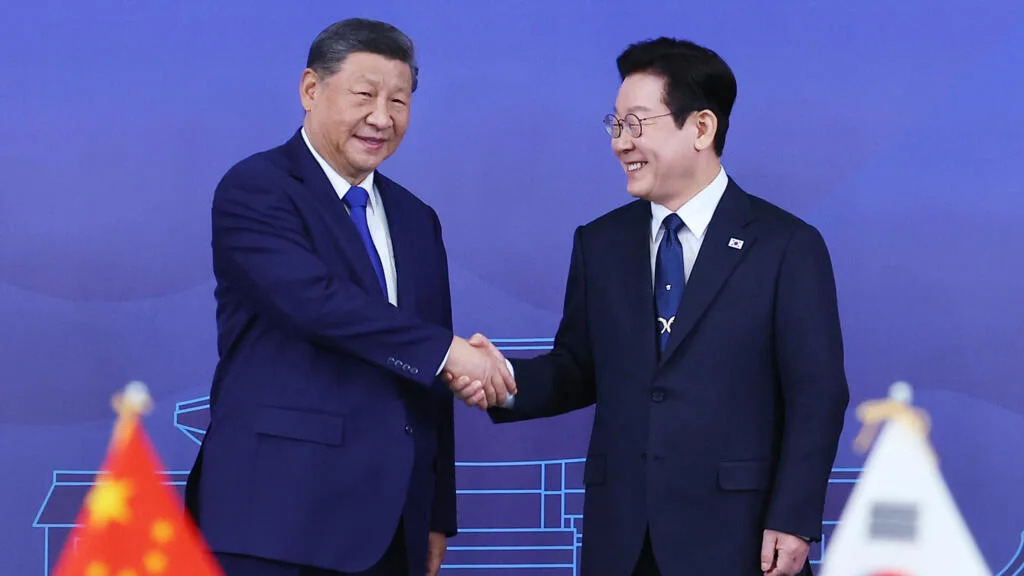

Farrell told Reuters on the sidelines of a CPTPP ministerial meeting in Melbourne that the October deal with Washington, which includes an $8.5 billion project pipeline, has prompted several governments to re-engage. “Having seen what we’ve done with the Americans, I think there’s increased interest from the Europeans, from the Japanese, from the South Koreans, Singaporeans, in what we’re doing in this space,” he said. “Particularly the Europeans don’t want to miss out.”

Read Also: US Australia Rare Earths Deal Targets China’s Market Control

China remains Australia’s largest trading partner and a dominant force in global mineral processing. Its decision earlier this year to tighten exports of some rare earths heightened concerns about supply chain stability, especially among countries seeking alternatives.

Canberra now aims to expand beyond mining and develop a larger domestic processing industry. As part of its talks with the US, Australia offered preferential access to its emerging strategic reserve, alongside a commitment by both governments to create a minimum price floor for critical minerals.

Farrell said the floor is designed to help companies compete with China’s lower production costs. But he acknowledged that countries with secure long-term supply, such as Japan, may be more hesitant to support such a measure.

Japan was an early investor in Lynas, the biggest producer of rare earths outside China. “I imagine those people, in that situation, might be the ones that might be arguing against moving down this path,” Farrell said. “But if we want to ensure reliable investment in these developments, there has to be some security at the end of it.”

The push to deepen cooperation on critical minerals also aligns with renewed efforts to finalise a broad trade agreement between Australia and the European Union, after talks collapsed in 2023. Canberra wants better access for its agricultural exports, while Brussels is expected to seek a firmer foothold in Australia’s minerals sector.

Farrell said the long-standing sticking points remain, but the geopolitical climate has increased pressure to reach a compromise. “The job over the next couple of days is to see whether we can find a common ground there, where our farmers get greater access but don’t ultimately threaten the livelihoods of European farmers,” he said.

He added that, given the current tensions around global trade, both sides need to demonstrate that major agreements are still achievable.

China has invested heavily in Australia’s metals sector over the past two decades, with about $6 billion committed since the early 2000s, according to data from the American Enterprise Institute. But competition has intensified as the US and EU attempt to secure their own supply routes.

As partners around the world look for steady suppliers, Australia’s strategic reserve has become an increasingly important bargaining chip.